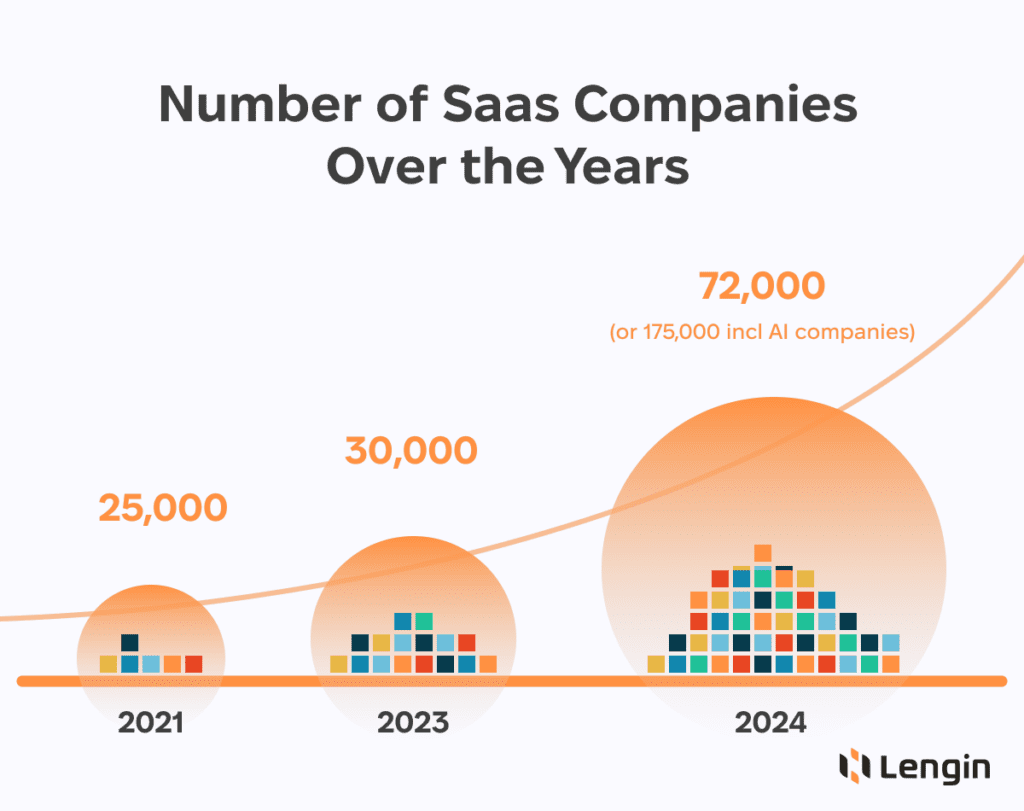

Statista shows that the number of companies specializing in delivering SaaS and AI solutions will dramatically increase to 175,000. It is an unexpected number, especially when the current amount is about 30,000.

What does 2024 hold for those industries to cause the doubling?

Table of Contents:

PaaS and DaaS

Everybody actively uses SaaS applications in daily life. The SaaS industry attracts the most users, but in 2024, Platform as a Service is going to become a new trend.

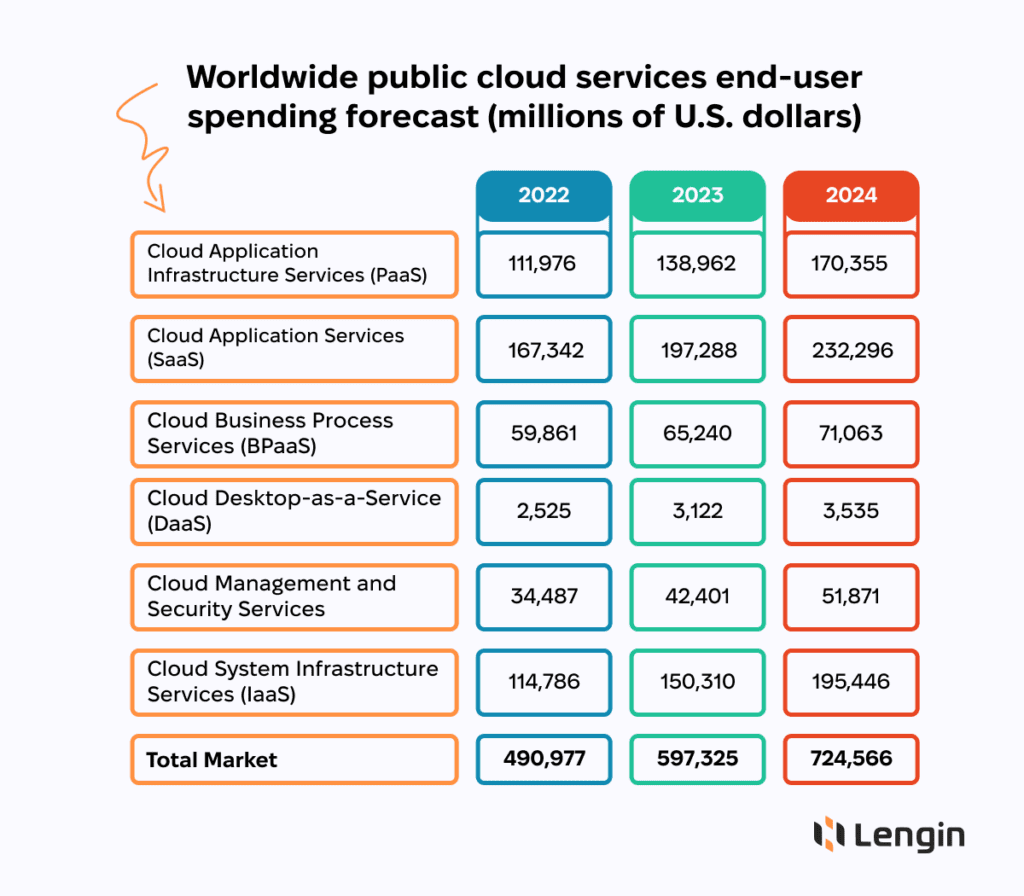

Gartner forecasts that PaaS will attract approximately 170,000 million USD spent by end users. A big pool of potential clients creates great potential.

PaaS is designed for developers. SaaS solutions are for the end users, so they are going to keep attracting the most funds, but then there is the necessity to build something like that to facilitate their development.

PaaS typically includes functionality for hosting, development, deployment, optimization, and many more instruments for developers.

Another fast-growing type is Data-as-a-Service. The world spins around data, and about 80% of companies surveyed by WEF are going to invest in big data analytics in 2024.

Rather than manage vast datasets themselves, companies can now access the insights they need through cloud-based solutions.

DaaS providers maintain enormous repositories of information, from customer profiles to operational metrics. Vendors process, integrate and analyze terabytes of real-time data using sophisticated infrastructure and analytics tools.

Through simple application interfaces, subscribers can explore predictive analytics, data visualizations, and automated reporting. This gives marketers rich audience insights to target campaigns. Manufacturers gain insights into supply chains to optimize production planning.

Vertical and Mirco SaaS

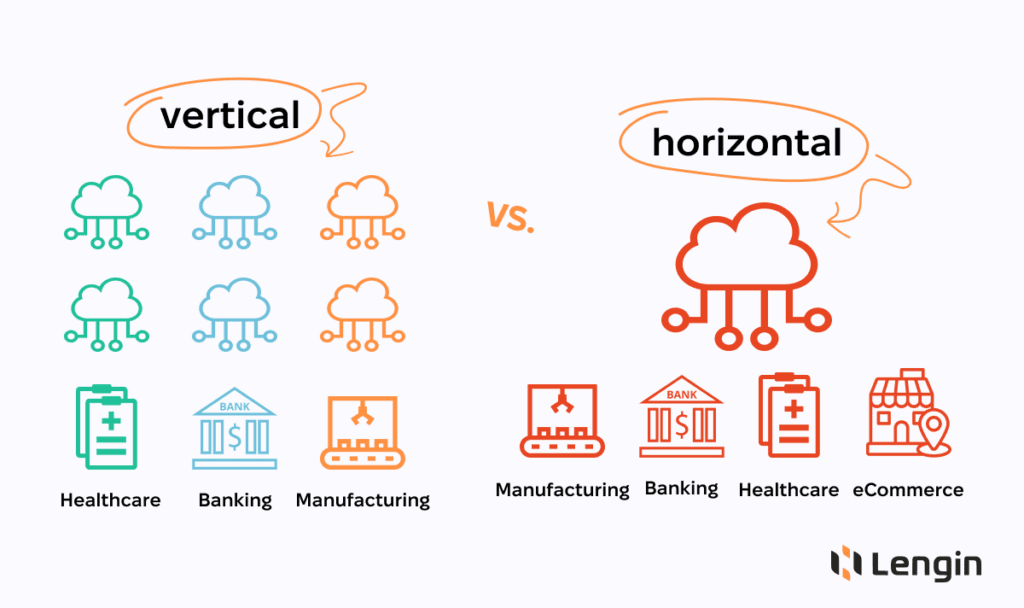

Vertical SaaS is all about focusing on the exact niche instead of trying to develop an all-in-one solution. Horizontal SaaS usually covers different industries and has more potential users.

For example, Google Workspace is a horizontal SaaS solution. Possible users: everyone. Modern Androids automatically backup your photos to Google Drive, so it’s literally everyone.

Vertical SaaS solutions can be highly specialized and offer a range of features that are unique to a particular industry.

An example of Vertical SaaS is toast. It is not a piece of bread but a custom SaaS solution for the restaurant industry. Toast covers all the management for many types of restaurants, but it focuses exclusively on this one industry.

Micro SaaS is even smaller than vertical SaaS — for example, the Grammarly browser extension and the plugin TranslatePress for WordPress.

Micro SaaS can be handy as an MVP. It is a cost-effective way to validate a market demand because businesses can test their ideas with a smaller, more specific audience.

As a result, the viability of a shippable piece of functionality of the future product can be estimated without big spending.

SaaS Market Consolidation

The bigger players in the space will continue scooping up successful smaller companies to expand their product lines. This way, they will expand their horizontal SaaS solutions with vertical ones to fill the gaps.

The financial impact of consolidation will also be quite noticeable for users. Premium subscription prices from integrated suites will surge while smaller startups find independent survival more challenging against these deep-pocketed behemoths.

Another probable consequence is an even bigger increase in competition and even higher barriers to entry into the market.

Competition is good for end users but creates tremendous obstacles for new startups. They will have to compete with industry giants or meet all the requirements for merging.

Consequently, a negative impact of market consolidation can result in a decrease in the number of startups and smaller companies, which are often the drivers of innovation. This way, the number of new and innovative products and services is bound to decrease, too.

Innovation and startups will still survive 2024. Larger companies may be more likely to acquire or partner with startups that have complementary products or technologies, which can provide a boost to startups’ growth and revenue.

If merging is not a solution, there is always a niche where micro vertical SaaS startups can find admirers and investors. Also, prudent marketing campaigns make magic.

RevOps, MarTech, and BI

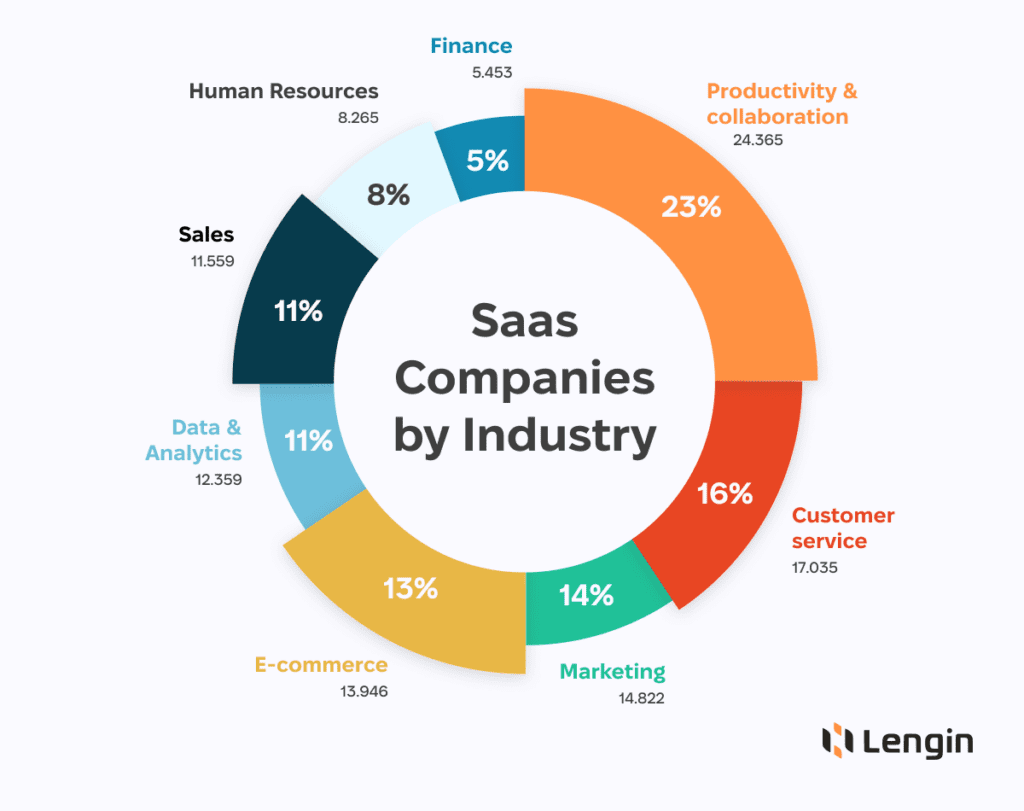

The latest statistics on SaaS solutions show that marketing, data analytics, sales, and finance hold almost half of SaaS companies. Those industries are focused on attracting more customers and increasing revenue, so it’s logical that efforts will be focused on satisfying those sectors.

MarTech, short for Marketing Technology, refers to the software and tools that businesses use to automate and optimize their marketing efforts. RevOps tools are the most popular in MarTech.

RevOps, or Revenue Operations, is a relatively new term in the technological field. RevOps is focused on optimizing all business operations, from lead generation to customer retention.

The ultimate goal is to maximize revenue by ensuring that sales, marketing, and customer success efforts are working together efficiently and effectively.

For example, AI-powered MarTech SaaS tools like Drift, Dynamic Yield, Salesforce’s Einstein Analytics, Gong, Adobe Experience Cloud, and Google’s Dialogflow provide innovative solutions for customer service teams.

BI, short for Business Intelligence, refers to the software and tools that businesses use to analyze and make sense of their data. They complement RevOps solutions for more efficient data interpreting.

Data-as-a-Service solutions are going to build a database for future RevOps solutions. It’s one more reason for the increased popularity of DaaS.

AI Integration

AI is everywhere, and integrating it into your product is more of a necessity than an innovation. A startup without an AI-powered chatbot is considered outdated.

Virtual assistants and AI-powered security tools are the most common examples. PaaS often includes optimization tools where AI algorithms analyze the code and make suggestions for optimization.

AI-driven DaaS solutions flooded the banking industry. Lightweight solutions, accurate data, automatic reports, and everything with the help of AI made them handy and functional instruments.

AI is not an innovative feature anymore and not a competitive advantage. AI is a must-have to enter the industry.

Conclusion

The SaaS market is one of the fastest growing in 2024. Gartner predicts that users will spend over 724,000 million USD on cloud-based applications. Among all types, Platform-as-a-Service and Data-as-a-Service hold one of the biggest potentials due to high demand.

Also, the number of vertical and micro SaaS applications is bound to increase. They are focused on solving a specific problem, which attracts a narrow target audience. Micro SaaS solutions are handy for startups because they can serve as an MVP.

SaaS market consolidation is inevitable. Big companies merge with promising startups to expand the coverage of markets in which they have gaps. This will lead to numerous consequences.

Many companies are concerned about their revenue and how to keep it stable. That’s why SaaS applications that include RevOps, MarTech, and BI are becoming the top on-demand solutions.

AI integration is nothing new. It’s a must to stay current.